Our underlying philosophy is that asset classes should compensate for the risks inherent in them. As we enter 2021, we look at the possible risks and expected returns. In summary, we see 2021 as a cyclical recovery year. We expect most asset classes (barring bonds, Sovereign and corporates) offering a positive return profile. However, all of the assets will be vulnerable to rising yields, We see a lot of "pockets" of idiosyncratic risks which could separately appear. We expect S&P500 to offer return of over 5-10% in 2021, factoring rising yields and strong earnings growth for the market. In aggregate, we think the risks outweigh the return profile for 2021, mostly on account of high valuations that we start the year with. We can see scenarios in which market could be 15- 20% during the course of the year. Consequently, we advocate a cautious, diversified and opportunistic market exposure in 2021.

2020 – An Exceptional Year

The year 2020 has been a roller coaster ride for investors. In March, the S&P 500 dropped by more than 30%. However, we also saw the sharpest rally in the following months. S&P 500 ended the year up 17%, a strong performance.

There was a variety of factors at play:

- Coronavirus, health, and economic disaster

- Central Bank and Government Stimulus

- Vaccine approvals in record time

As the year ends, we need to put our thinking caps on and forecast risk and returns for the markets again.

2021 – A Year of Improving Fundamentals; but Also of High Expectations

2021 could be a year of healing, optimism, and the establishment of an entirely new world, both professionally and personally. We expect a strong cyclical rebound with most major economies in the world bouncing back to pre-covid levels. Aggressive vaccine roll-outs will lead to increased normalization (especially in impacted sectors such as hospitality. However, we suspect several asset classes and sectors have stretched expectations. These could lead to disappointments and selective “bubble bursts.”

Risks As We Enter 2021

2020 was characterized by (1) once-in-a-generation health disaster; (2) Unusually low risk-free rates; (3) Monetary and Fiscal stimulus of scale not seen since World War II and; (4) US$ devaluation.

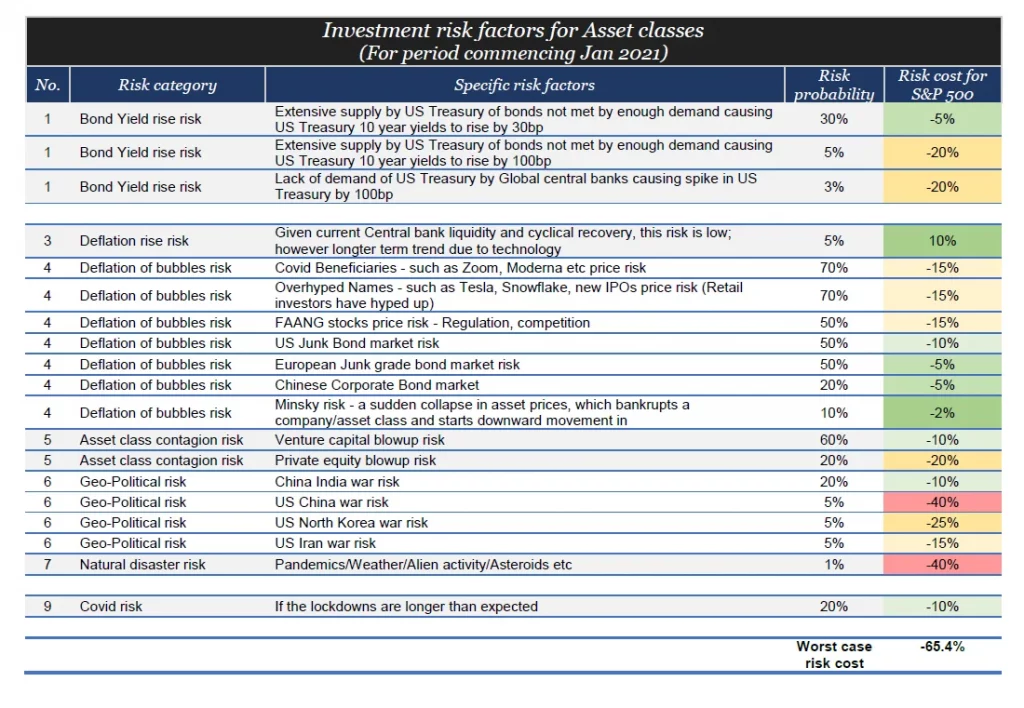

2021 will likely see policy remaining favorable and the health disaster contained by vaccinations. However, we foresee the following risks which stand to hurt the most:

Asset Markets: A Confluence of Three Major Factors

We estimate that the US Treasury will likely issue $3 trillion worth of debt securities in 2021 to fund its deficit. The Fed would have to expand its buying program. If the Fed decides otherwise, the yields will likely rise. An increase in the risk-free rate can significantly impact asset prices.

Increased Inflation:

So far, US CPI inflation has remained benign at c. 1.2%. This gave a lot of leeway for the Fed. However, we see the possibility of inflation reaching higher than 2% by the end of 2021. Several factors could contribute to this (1) Supply shortages; (2) Pent-up demand; (3) Depreciating the Dollar, leading to imported inflation. While the Fed has moved its mandate to a more flexible inflation targeting, a sudden increase in inflation could put a stop to Fed’s very easy monetary policy.

Deflation of Bubbles Risk:

We believe increased liquidity created by the US financial support to contain coronavirus impact has caused the creation of asset bubbles in many asset classes. Valuation looks expensive. S&P500 Index rose 27% in 2019, and it rose close to 20% in 2020. Fed’s quantitative easing programs are cited to be one of the reasons for increased valuations. Some areas we see increased risks are:

- Covid-19 Beneficiaries – We have seen the new world technologies such as Zoom, Fiverr, Moderna showing immense price appreciation. These firms can have significant gains from people working from home, increased freelancing, and future pandemics. However, we believe street expectations are also now elevated, and valuations might be extreme.

- Overhyped Names – Nasdaq Composite is up more than 40% this year, and names such as Tesla, Snowflake, and many new IPOs have been hyped up, especially among retail investors. They are showing abnormal price appreciation.

- FAANG stocks price risk –FANG+ companies are up 100% this year. However, regulatory pressure as these companies become too-big-to-fail is a big risk going forward

Coronavirus:

While our base-case remains that rapid vaccinations will lead to a strong economic rebound in the 2H 2021, there are various risks to our view:

- Vaccine Failure Risk: Vaccines have been approved at an extremely fast pace. There is a chance that side-effects get detected when mass immunization is in progress.

- Virus Mutation: Virus mutation might lead to ineffective vaccines or increased transmission.

Deflation of Bubbles Risk:

- US-China War Risk: As Ray Dalio of Bridgewater highlights, whenever a rising power (China) challenges the incumbent power (USA), there are frictions that could lead to a full-blown war. Short of a full-blown war, we see various other wars (Capital War, Technology War, and Trade War) likely to persist into 2021.

- US-North Korea War Risk: Aware of these two nations could cause millions of deaths due to their nuclear capabilities. They have come very close to war, and it remains a possibility. It would be awful for the US economy.

- US-Iran war risk: Tensions have remained high since the US-led operation killed an Iranian general. This has the potential to cause the Persian Gulf Crisis can make US growth falter if it must spend on warfare.

Our Return Expectations for 2021: 5-10% for the S&P 500

We foresee three factors driving equity returns in 2021. These are:

- Earnings growth: We see a strong rebound in 2021 EPS. According to Yardeni, the EPS for S&P 500 for the first, second, third & fourth quarters can grow by 15%, 46%, 13% & 22%, respectively. The expected EPS for 2021 is around US$ 169, which means around 24% growth expected for EPS for 2021 versus 2020. In the long term, we expect the earnings growth for the index will be around 5%.

- Risk-free rate: Factors that have driven the equity market returns across the globe in 2020 are the all- time low risk-free rate and continued support from the central banks. While we expect the central banks to continue supporting the asset markets in 2021, we expect the risk-free rate to increase to 2%.

- Equity risk premium: In terms of Equity risk premium, we expect it to be around 2.8% for 2021. As you can see in the figure below, taking all three factors into account, we expect the S&P 500 to give a stellar return of around 28% in 2021. The expected long-term return is around 9%.

Disclaimer (Full disclaimer in definitive documentation). This Information Document is provided solely for the information and exclusive use of the Recipient, and may not be communicated, photocopied, reproduced, disclosed, or distributed to any other person at any time except as agreed in writing by the Company. This Information Document is not an offer or invitation to sell or acquire any shares, securities or any assets or other interests of whatever nature and shall not be taken as any form of commitment or recommendation on the part of the Company to proceed with any transaction. A proposal regarding the Transaction will only give rise to any contractual obligations, express or implied on the part of the Company when a definitive agreement has been executed. Nothing contained herein shall be deemed to constitute an agreement by the Company to permit the Recipient to have unrestricted or any other type of access to the Company's information, books, records, employees or otherwise.

Current Role:

Current Role: