We are Gold bugs, but usually only in an asset allocation perspective. We believe Gold has unique characteristics that offer it a place in a well-diversified portfolio.

Having said this, we think the yellow metal has a specific case for investment during current times. Our study of financial history over the past 100 years shows that Gold is less of an inflation hedge (contrary to popular belief) and more a “tail-risk hedge”. Gold does very well in crises, esp. those where the faith in the financial system is at risk or where the market is expecting a paradigm change (e.g., Gold Standard ending)

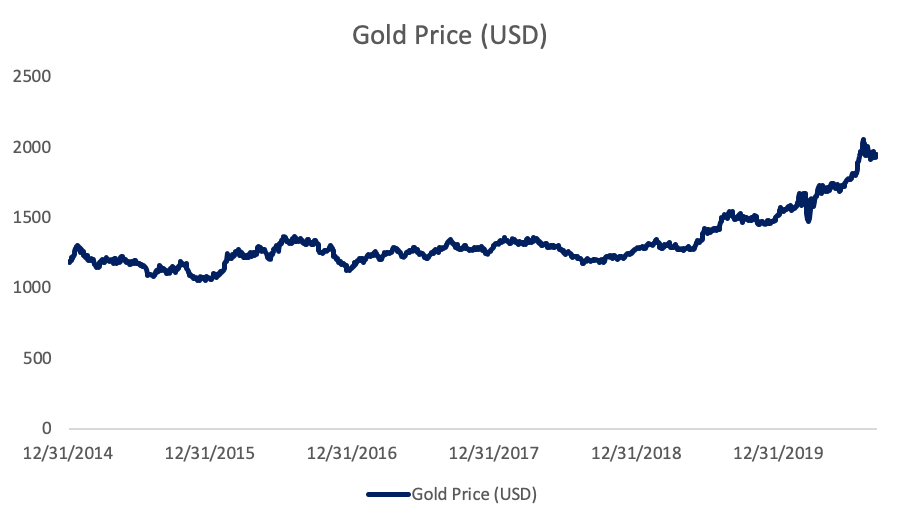

Gold is up 27.6% this year. This is after a strong performance in 2019 (up 18.8%). This, we believe, is linked to market fears of dollar debasement given the massive QE being carried out by the Fed (and likely to continue over the coming years).

We expect Gold prices to show the positive momentum on a medium-term basis due to strong investment demand and possible recovery in demand for physical bullion as well as demand from central banks.

Gold in a portfolio context:

Our approach of risk vs. return premium shows that Gold offers a good risk-adjusted return on its own. However, in a portfolio context, it provides a negative correlation to Equities.

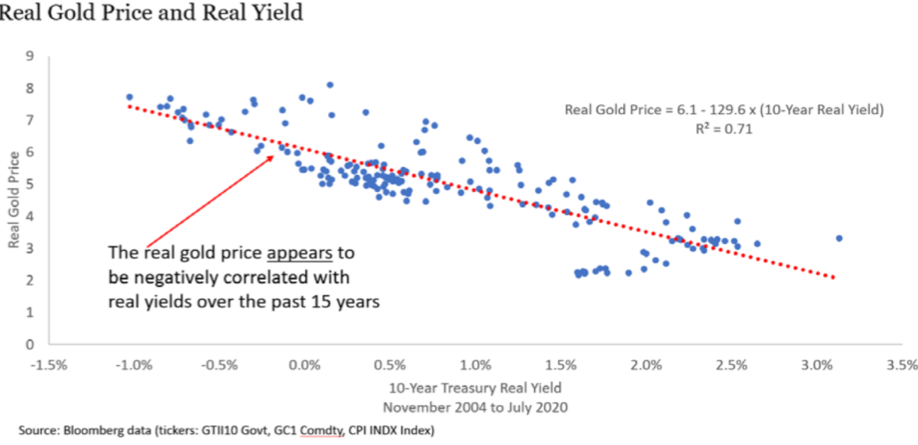

Gold and sovereign bonds are considered as safe assets. During the time of recession, these two asset classes perform better than other asset classes. Gold has always faced the criticism of not generating any cash flow, whereas bonds give fixed coupon payments at a fixed interval of time, making it more attractive. But 2020 is not a typical year in any sense. Due to all-time low-interest rates and higher future inflation expectation (due to the massive stimulus), the real yield (nominal interest rate – breakeven inflation expectation) has turned negative. This makes Gold more attractive to investors. The real gold price and the real yield appear to be negatively correlated over the past 15 years, which means whenever real yield goes down, Gold tends to appreciate in value.

Gold: Why is it interesting on its own?

We are in unique times. To counteract the impact of Covid-19 related slowdowns in the economy, Central Banks around the world have injected large amounts of money into the system. We have talked at length in https://torch-insights.com/2020/07/29/the-big-fed-put/

This has led to fears of US Dollar debasement. DXY, an index of USD against a basket of currencies, is down c. 9% since March 2020. Market participants are forecasting further debasement. This is increasing investment demand into the metal.

We spent some time understanding the Demand and Supply of Gold.

Gold Supply: Constrained. And hitting limits

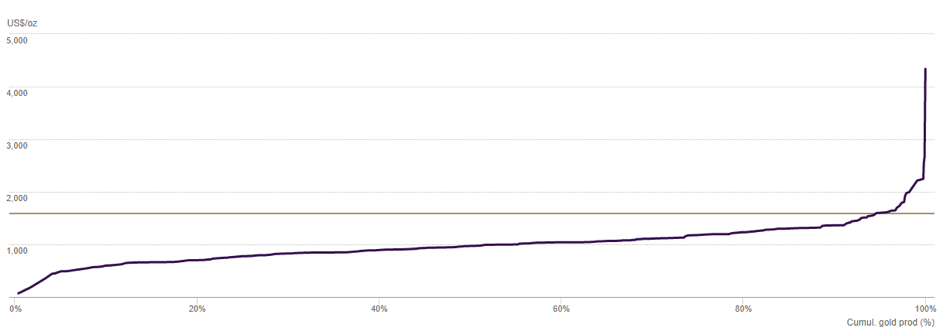

Gold’s appeal is precisely because there is a limited supply on Planet Earth (We put it this way as there are speculations that once we conquer outer space, there is unlimited supply. But prospects of that in our lifetimes, let alone in our investment horizon, are limited). According to Barrick Gold, one of the largest gold miners in the world, the Gold industry has NOT made any significant discovery for almost a decade.

So, the gold supply is constrained. If demand starts rising and is inelastic, we could see an exponential increase in clearing price for the metal. We are not there yet. The demand and supply of the yellow metal is currently balanced. At the current levels, demand is c. 90-95 % levels of the current supply. But as the “Cost Curve” for all gold producers, according to the World Gold Council, shows below, small increases in further demand can cause a sharp increase in gold prices (as the price will get decided by the last marginal supplier, whose cost is much higher).

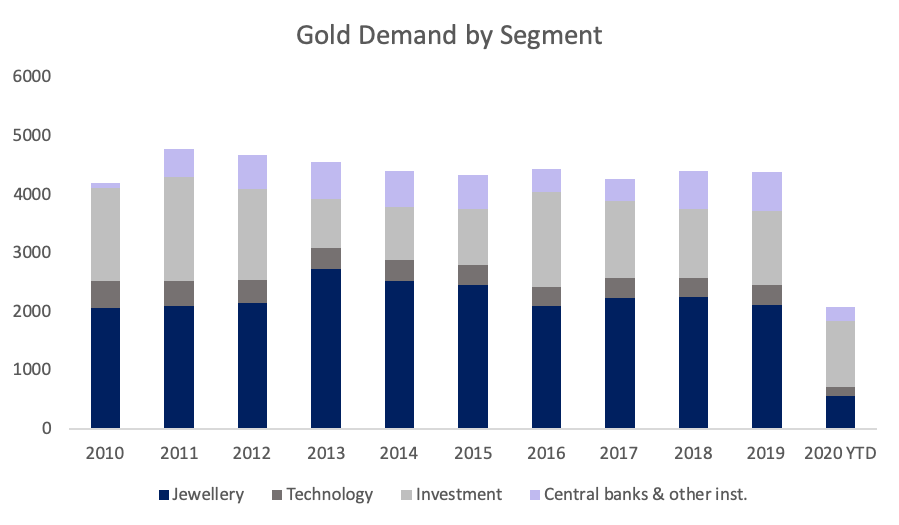

GOLD DEMAND: Relentless investment demand over the past two quarters more than offsetting muted physical demand.

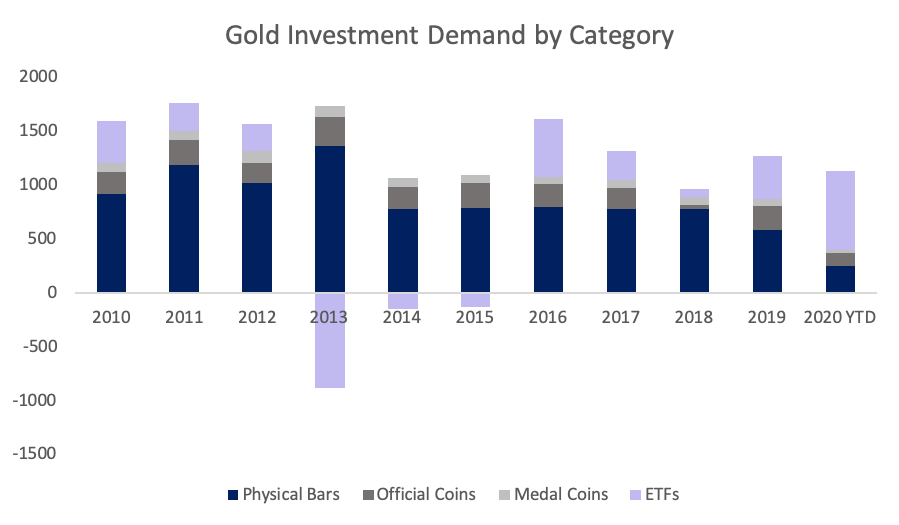

Strong Inflow from ETFs offsetting the muted physical demand

Gold has seen steady inflow from ETFs, indicating the strong investment demand for the metal. ETFs across the globe added around 898 tonnes of Gold in 2020 vs. the previous all-time high of 646 tonnes in 2009.

As can be seen here, there has been a consistent investment demand in Gold over the past few years. However, the past two quarters have seen a sharp increase in

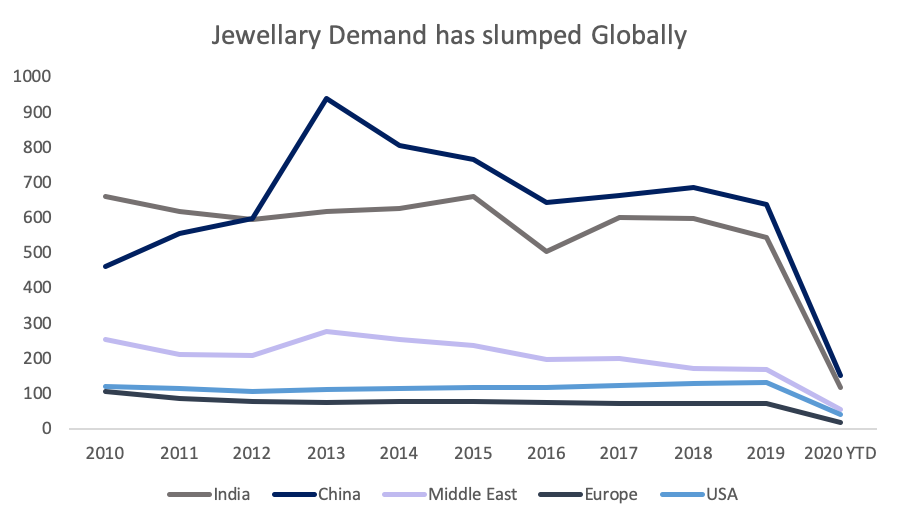

The investment demand has undoubtedly picked up across the globe, but the physical demand for Gold is seriously hit by the COVID pandemic. Jewelry demand has declined to 572 tonnes in the first two quarters of this year vs. 1065 tonnes in the same period last year. The demand from countries like India (which is one of the major sources of demand for Jewelleries) slumped 74% in the first half of the year.

ETFs a major contributor

Over the past 2 quarters, ETFs have contributed around 56% of the total Gold demand.

Allocation in Investors portfolio is still lagging the 2011 levels

Gold made an all-time high of USD 2,075 in August 2020, but if we adjust this for inflation, the all-time high was made in 2011. In 2011, there was an all-time high allocation towards gold relative to other asset classes. This is not the case right now. Allocation towards Gold is currently just 2.5% of the total known ETF holdings vs. 10% in 2011. Moreover, the demand for Gold was from across the segments, not only in investment demand. We can see an increased allocation in investors’ portfolio in the second half of 2020, providing another tailwind for the metal.

Upside case

We are unable to take a view on ETF flows, whether they will continue or not. However, IF these flows continue, there could be a high chance that Gold goes up from here. We have not yet factored in another player in the Gold space – the Central Banks.

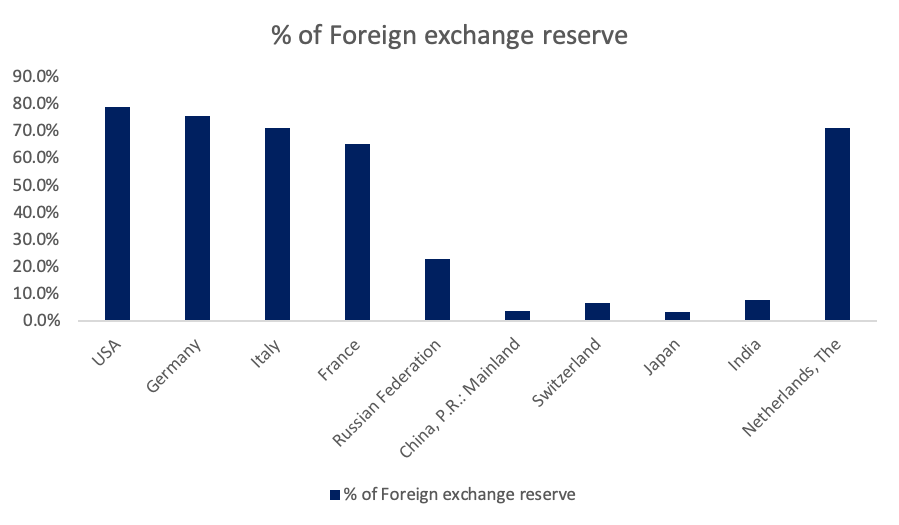

The Federal Reserve of the USA holds the largest reserve in comparison to its peers. Some of the developed countries like the USA, Germany, Italy hold a maximum portion of their foreign exchange reserve in Gold. In contrast, developing nations like India, China have a tiny part of their reserve in the yellow metal. These nations have a significant portion of their reserves in US dollar, and any significant weakening in the global reserve currency may result in increased allocation towards Gold by these banks. This demand could be much greater than any ETFs.

Disclaimer

The information contained on this article has not been examined or approved by any regulatory authority. Nothing contained in this article shall constitute any investment advice, solicitation or offer by Torch Investment Management Pte. Ltd. (“Torch”).

This article is for information purposes only and is not intended to be relied upon as a forecast, research or investment advice. Although the information provided in this article is based upon information that Torch considers reliable and endeavors to keep current, Torch does not assure that the information is accurate, current or complete, and it should not be relied upon as such. Any opinions expressed in this article may change as subsequent conditions vary.

Current Role:

Current Role: