Cryptocurrencies adoption is happening but at a much slower pace than expected. Investments are coming in with the expectation of higher return when cryptocurrencies will become mainstream. Cryptocurrency has been in existence for almost a decade now. Investors and founders have high hopes of gaining traction and making it mainstream.

However, cryptocurrency becoming mainstream does not seem probable. It has its issues relating to governance, decentralization, consensus, and adoption. If it becomes mainstream, it will pose an immense risk to the financial and economic system of the world. It’s something we have not seen before. It can either be a disruptive force or a destructive one. Once there is panic in the cryptocurrency market, it is tough to contain as the past as shown.

Our current financial system is dependent on governments to regulate and control in case of panic or unprecedented event. No such mechanism exists in the cryptocurrency domain.

Even though cryptocurrency might not become mainstream, but they will always find adoption in a niche market which will include technocrats and privacy-oriented individuals.

Only time will tell whether cryptocurrency gains significant market share or proves to be just a fad destined for black markets or illegal activities.

Challenges to cryptocurrency adoption:

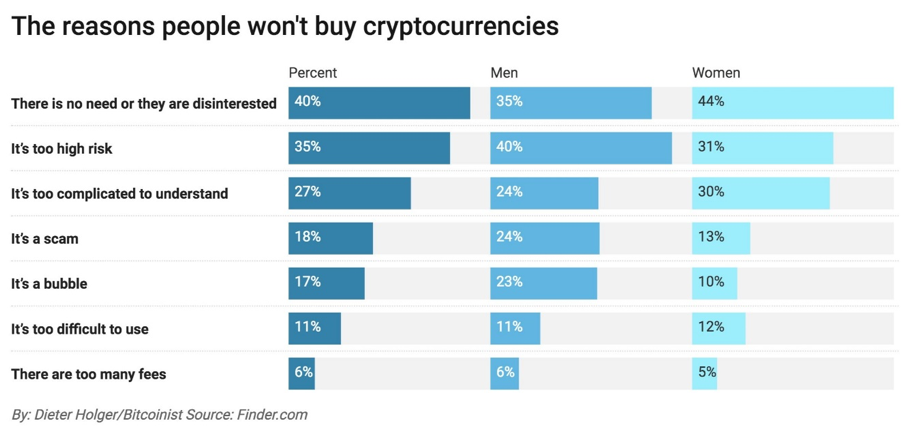

Complicated User Experience: Creating wallets, storing secret keys and making transaction using long wallet addresses makes it difficult for simple users to adopt cryptocurrencies. UI/UX needs to be simplified so that anyone can use it without worry much.

Everchanging Thesis of Cryptocurrencies: Purpose of cryptocurrencies, particularly bitcoin’s, has not been clear in almost a decade. Fanboys said it was digital cash, then digital gold, then a separate asset class. It is not in its final form yet.

Extreme Volatility: Prices have known to show extreme moves in cryptocurrencies. We need low volatility in prices to use them for making purposes, otherwise there will be a sense of loss or gain when price appreciates or depreciates.

Regulatory Hurdles: Though cryptocurrencies are legal in many countries, it is treated as a property, not like a valid currency. We need better regulations to make it clear to people that dealing in cryptocurrency is legal.

Speculation: People hold on to cryptocurrencies rather than transacting with them, in expectation that they will sell it at a higher price. This market has become a gambling den.

Scams and Hacks: People have lost money when various exchanges got hacked. Also, many firms cheated investors of millions of dollars in Initial Coin Offerings.

Criminal Association: Origin of Bitcoin is also linked to the usage on the Silk Route website which is for buying and selling drugs.

Current Role:

Current Role: