In recent years, the MENA region has emerged as a hotspot for deal-making across various industries, setting the

stage for unprecedented growth opportunities. Despite its GDP accounting for 4.1% of the global GDP in 2022,

M&A activities in the region represented only 1.4% of worldwide deals by value. Large corporations operating in

the region have the opportunity to drive economic expansion through effective M&A strategies. However,

navigating this dynamic landscape presents its fair share of challenges, including high liquidity fueled by Sovereign

Wealth Funds (SWFs), valuation disparities, regulatory complexities, and the lack of transparency surrounding

target companies.

Global M&A landscape

In 2021, the global M&A landscape reached a record-breaking all-time high, with a total deal value of US$5.9 Tn,

representing a CAGR of 7.3% between 2014 and 2021. We are witnessing both quantitative and structural changes

in the M&A landscape, as highlighted by a recent survey conducted by Mergermarket, revealing that ~80% of

executives (200 deal makers including large corporates & PEs) acknowledge M&A as an integral part of their

broader business strategy.

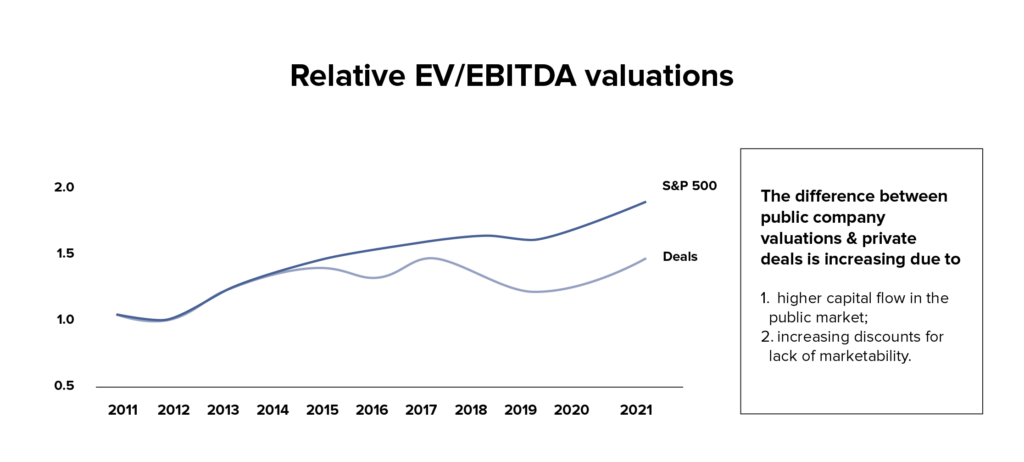

In the last two years, public market trading multiples, particularly the S&P 500 companies, have experienced a

notable surge, surpassing the growth seen in M&A deal multiples in the US. This increase can be attributed to the

combination of low-cost capital and abundant liquidity in the public market, resulting in a substantial valuation

disparity compared to private companies.

Given the current economic landscape, with challenges like supply chain disruptions and structural inflation

hindering organic business expansion, there is an increasing emphasis on inorganic growth. Deal executives should

seek out strategic acquisitions at favourable multiples to enhance the financial performance of public companies.

We believe that large corporations, both public and private, can develop an arbitrage model based on the

fundamental disparities in valuations between a) publicly listed companies and private companies, and b) large

private companies and small private companies to fuel growth during this turbulent period.

MENA M&A landscape

In line with the global trend, the MENA region witnessed robust M&A growth in 2022, with 754 deals (13% YoY

increase) totalling US$83 Bn, with 55% of M&A deals ranging between US$50-250 Mn. While this marks an

improvement from the historically 500-600 deals, it still represents a small fraction (~1.4%) of the global market.

In 2022, MENA region-based targets accounted for approximately 73% of the deal volume, indicating positive

implications for local economies. The TMT sector emerged as a highly sought-after industry in the region, mirroring

the global trend. The top five sectors that are expected to attract the highest investments, in order, are a) TMT, b)

industrial and chemicals, c) consumer and retail, d) pharma, medical and biotechnology, and e) financial services.

In terms of geographical concentration, MENA deals were concentrated in Israel (485 deals in 2021-22, 87% YoY

increase), followed by the UAE (190 deals, 79% YoY increase), and Saudi Arabia (75 deals, 17% YoY increase). We

expect a significant increase in the proportion of deals occurring in Saudi Arabia in the coming years.

Challenges in deal-making within MENA region

In contrast to the global or developed markets, the MENA region presents unique challenges that necessitate a

deeper understanding of specific attributes. Some critical components to consider are:

- Agreeing on favourable valuations: Contrary to the common belief that smaller markets command lower

multiples, deals in the MENA region can occur at higher multiples than in developed markets. For example, in

2019 (pre-COVID analysis), in Real Estate & Manufacturing, average EMEA multiples were 21.3x vs. global

12.4x average. In the Financial sector, EMEA multiples were 13.2x compared to the global average of 8.5x.

Utilities recorded 11.6x in EMEA vs. 7.1x globally. These figures challenge conventional expectations and

highlight the need for a nuanced understanding of the MENA region when assessing investments. - Strong competition from other buyers: SWFs and state-linked organisations such as ADIA and PIF, with

their substantial wealth, possess the capability to outbid other buyers in fiercely competitive bids. Consequently,

33% of foreign buyers and 39% of dealmakers in the MENA region view intense competition from other buyers

as a significant obstacle to attaining targeted returns through M&A activities. - Other challenges: Identifying suitable targets with attractive Internal Rates of Return (IRRs), ensuring

compliance with regulatory requirements, and limited transparency regarding target companies’ data.

Additionally, seller expectations in the region tend to be higher, with a preference for an immediate cash-out

option.

Sealing the deal

Recognising the above core challenges is imperative for both the acquirer and the target. Unfortunately, the burden

of devising a sound acquisition plan falls on the acquirer, requiring them to be more considerate in this region.

Breaking deals mid-way by overstressing these issues can harm the overall inorganic growth strategy of large

corporates of the region (we believe paying a higher control premium is less detrimental than the opportunity cost

of the deal). Therefore, it is essential for the large corporates within this region to take the following into

consideration:

- Formulate a solid deal strategy: Take a comprehensive approach to the deal, considering factors beyond

deal value and transaction multiples. Engage with the target’s representatives to effectively convey the deal’s

rationale and involve them in value creation. This may require patience in handling intense arguments and

adjusting expectations as well as encompassing initial acquisitions at higher multiples, longer payback periods,

and lower returns. Over time, large corporations can overcome these challenges by developing a robust

acquisition strategy. - Be innovative: Large corporates should drive innovative deal-making. While target’s representatives may

overlook the broader perspective, acquirer’s representatives must be proactive and detail-oriented in

strategically structuring deals. In addition to traditional mechanisms like earn-outs, free shares, ratchet

mechanisms, royalty agreements, etc., executives should also consider diverse financial instruments to mitigate

risks associated with the deals. - Expert guidance: Engage an experienced market expert to facilitate the successful execution of your

transaction. The region’s M&A activities require a significant push from asset managers, PE/VC funds, and large

corporates who understand the market well.

Conclusion

Despite the scarcity of deals and the novelty of the M&A concept in the MENA, the region demonstrates remarkable

resilience and the potential to become a preferred deal market in the next 5-10 years. This is supported by the

impact of strong oil prices driving economic growth and investor confidence.

Unlike the global or developed markets, the MENA region requires a deeper understanding of unique attributes

that make the deal-making process more complex. While business rationale and financial metrics remain

important, behavioural finance plays a crucial role in deal closures in the region.

*Source: Global M&A Report by Bain, MENA M&A Report by EY and Statista Website

Disclaimer

This Document is not an offer or invitation to sell or acquire any shares, securities or any assets or other interests of whatever nature and shall not be taken as any form of commitment or recommendation on the part of the Company to proceed with any transaction.

Opinions expressed herein are not intended to be a forecast of future events, a guarantee of future results for investment advice, and are subject to change based on market and other conditions.

Current Role:

Current Role: