Pandemic and Policy Measures: In 2020, the global economy underwent a sharp and brief economic recession caused by the Covid-19 pandemic, prompting policymakers worldwide to swiftly implement measures aimed at stimulating their respective economies. The US government responded by announcing a fiscal stimulus package of US$ 4.2 Tn*, while the US Federal Reserve reduced policy rates to near zero and expanded its balance sheet by US$ 4.3 Tn**.

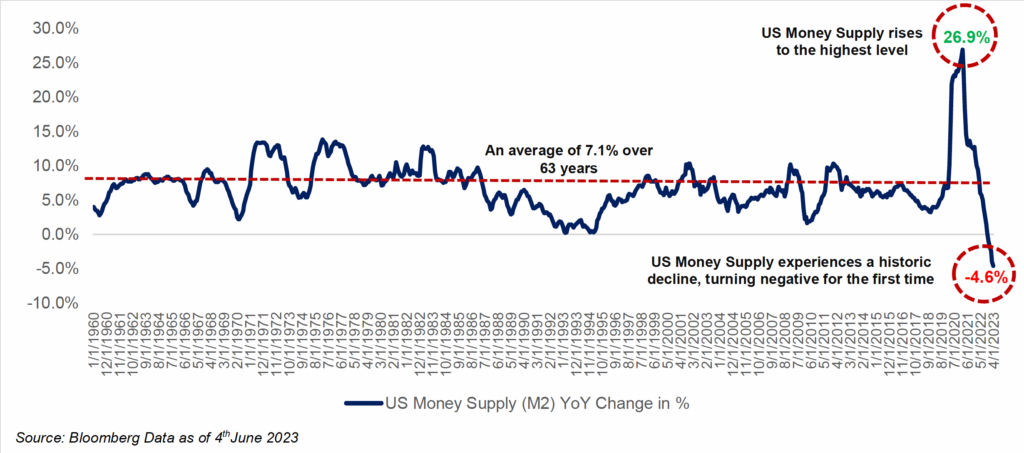

Global Liquidity Surge: The implementation of policy measures led to a significant boost in global liquidity, causing the US money supply to surge to an unprecedented peak of 26.9%, surpassing the long-term average of around 7.1%. We observed a significant surge in demand, yet the supply side struggled to keep pace due to constraints. The combination of a robust money supply, strong demand, and limited supply resulted in an unprecedented inflation rate, reaching its peak at 9.1% in June 2022.

Hawkish Approach: In an effort to curb the escalating inflation, the US Federal Reserve implemented quantitative tightening by a rapid increase of the policy rates to 5.3% within the past 14 months. This was accompanied by a simultaneous reduction in the balance sheet by approximately US$ 95 Bn per month. The hawkish approach adopted by the Federal Reserve has led to an unprecedented occurrence: a negative money supply, with the YoY% change in the US money supply reaching -4.6%.

Torch’s Outlook: We believe that this unprecedented occurrence of negative money supply will have repercussions not only for the global economy but also for asset prices:

- We anticipate that global liquidity will be adversely affected due to the tightening policies of central banks and the limited availability of money supply.

- Economic activities could experience setbacks as the key driver (liquidity) is drained out of the system.

- We also foresee that this slowdown will impact companies’ earnings, potentially leading to an earnings recession in the future.

Hence, we hold a bearish outlook on risk assets and anticipate the possibility of a significant global asset price meltdown.

* Source: https://www.usaspending.gov/disaster/covid-19?publicLaw=all

** Source: Federal Reserve Total Assets Wednesday Level, Bloomberg, Torch Estimates

Disclaimer

This Information Document is provided solely for the information and exclusive use of the Recipient, and may not be communicated, photocopied, reproduced, disclosed, or distributed to any other person at any time except as agreed in writing by the Company.

This Information Document is not an offer or invitation to sell or acquire any shares, securities or any assets or other interests of whatever nature and shall not be taken as any form of commitment or recommendation on the part of the Company to proceed with any transaction. A proposal regarding the Transaction will only give rise to any contractual obligations, express or implied on the part of the Company when a definitive agreement has been executed. Nothing contained herein shall be deemed to constitute an agreement by the Company to permit the Recipient to have unrestricted or any other type of access to the Company’s information, books, records, employees or otherwise.

Current Role:

Current Role: